Do I Need To Register As A Business If I Get A 1099 Form

If you're getting started equally a freelancer or your small business organisation is contracting exterior assist, you've probably heard of IRS Form 1099. Only what is information technology, exactly? And how do you file it? Hither's everything you need to know.

What is a 1099 tax form?

A 1099 is an "data filing grade," used to written report not-salary income to the IRS for federal tax purposes. There are twenty variants of 1099s, but the well-nigh popular is the 1099-NEC. If you paid an independent contractor more $600 in a financial year, yous'll need to complete a 1099-NEC.

An private can also make money from tax dividends, prize winnings, interest income, IRA distributions, state taxation refunds, miscellaneous government payments, the sale of personal belongings, or fifty-fifty credit carte debt forgiveness. These types of income are reported on other types of Form 1099, which you lot tin read all most here.

If you lot're a small business organisation owner, you lot'll virtually often be dealing with Form 1099-NEC, so we'll focus on that one.

Suggested reading: Course 1099 Filing and Reporting Requirements

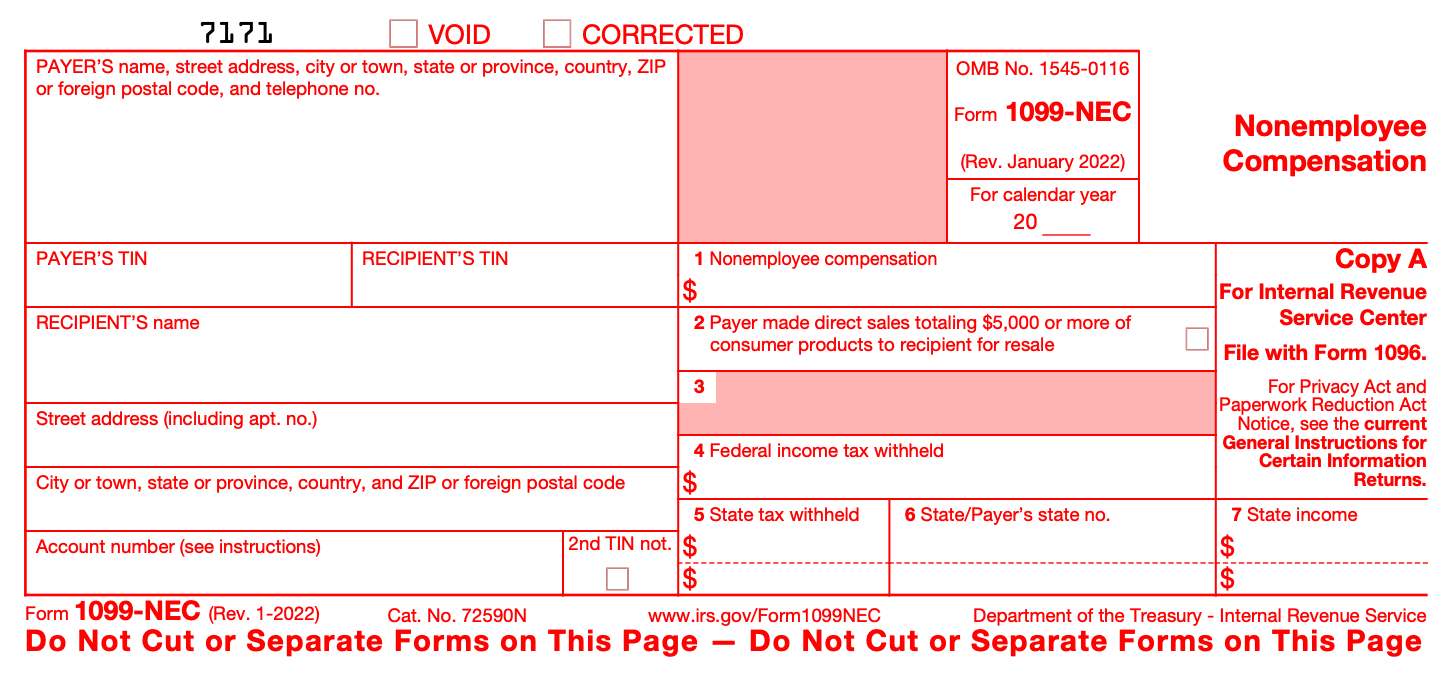

Grade 1099-NEC, Copy A

Grade 1099-NEC, Copy A

What is a 1099-NEC Course?

1099-NEC is the version of Grade 1099 you use to tell the Internal Revenue Service whenever you've paid an independent contractor (or other self-employed person) $600 or more in compensation. (That'southward $600 or more over the grade of the unabridged year.) The IRS uses this information to independently verify your income, and therefore your federal income taxation levels.

If you lot're an independent contractor, it's non your task to file the 1099-NEC. But if you don't receive a re-create of the 1099-NEC from your client, you should follow up with them. Independent contractors will need to study all their income on Schedule C, even if information technology falls under the $600 range and there wouldn't show upwards on any 1099s.

Independent contractor definition

An independent contractor is anyone you hire on a contract basis to complete a particular project or assignment. By definition, an independent contractor is non an employee. Common examples include graphic designers, web developers, copywriters, and social media consultants.

If you hire a freelancer through a 3rd-party service, you may not be required to submit a 1099 for them. For instance, if you hire a freelancer through Upwork, Upwork is actually the one doing the hiring, so you don't need to submit a 1099.

These details vary from ane 3rd-political party hiring service to another. Check out the company'due south "About" or "FAQ" section for tax filing details earlier you first using their service.

Who gets a 1099?

All contractors and partnerships who did more than than $600 of piece of work for your business should receive a 1099.

Who needs to fill out a 1099 form?

If your business hired the contractor and paid them more than $600 in a year, y'all're responsible for issuing them a 1099-NEC. In other words, the payer fills out the 1099.

The $600 cut-off

If you paid an independent contractor less than $600 over the grade of the financial yr, you lot don't demand to submit Grade 1099-NEC for them.

Keep in mind that if you're an contained contractor, you still need to study all your income. Even if you did less than $600 of work for a customer and never received a 1099.

If yous did pay a contractor more than $600 for services, y'all need to file a 1099. But there are exceptions to this rule.

Don't file 1099s for corporations

It's rare, but sometimes an independent contractor will be registered every bit a C corporation or Southward corporation. You don't need to file Class 1099 for a contractor registered every bit a corporation.

You lot tin can encounter whether a contractor is incorporated based on the information on their Grade W-9. Asking 1 from any contractor as soon as you hire them. Also keep in mind that corporation names are typically appended with ", inc."

Don't file 1099s for employees

The IRS makes strict distinctions between employees and nonemployees. And they're often on the lookout for business organization owners who misclassify workers as independent contractors (typically in guild to avoid paying social security and medicare taxes.)

You'll need to file a Form W-2 to report wages, tips, and other compensation y'all paid to an employee during the tax twelvemonth.

At that place are pregnant penalties for misclassifying employees every bit contained contractors. Make sure you know how to tell the difference between an independent contractor and an employee earlier y'all submit a 1099.

Don't file 1099s for contractors hired through freelance marketplaces

Freelance marketplaces similar Upwork or Fiverr don't provide revenue enhancement documents. Why'south that? Because they're technically payment settlement entities. Businesses do non need to provide 1099-NEC forms to workers they hire on these platforms.

If you're a freelancer that finds work on these platforms, you volition a class 1099-kif you earn more $20,000 and have 200 transactions. Otherwise you tin find all the data you need for tax filing in your account.

Do partnerships get a 1099?

If y'all paid a partnership more than $600 during the revenue enhancement yr, then yous must issue them a 1099-NEC.

1099 example for independent contractors

Suppose you're a freelance graphic designer, and a local coffee shop chosen Whole Latte Dearest pays you $1,000 to design their new logo.

Y'all exercise the work, and they dear it. Come tax flavor, they send you a Course 1099-NEC, only like they're supposed to.

At present suppose you don't hear from Whole Latte Love for a couple years. They eventually come dorsum and want a calorie-free design refresh of their logo—"something more minimalist". Yous get the changes made in one day, they love it, and yous bill them for $450.

In this case, they would non send you a 1099-NEC considering you lot didn't do $600 of work for them. Notwithstanding, you'll yet need to written report that $450 income on your tax return, and pay self-employment and income tax on it.

1099 case for small business owners

Let's say yous own a mini-golf game class, and information technology needs some touching upwardly. You hire a local landscaper to come in and beautify the expanse around the eighteenth hole.

The landscaper works solo, operating as a sole proprietorship. He comes in and plants 18 miniature palm copse. Information technology looks fantastic, and merely costs $3,000.

During revenue enhancement season, it'due south upwards to yous to send him a Form 1099-NEC, recording the amount you paid him, and the service you're paying him for. You'll also transport a re-create to the IRS.

Now let's say a wintertime tempest blows in and kills off all the palm copse. You realize, based on the local climate, tropical plants may not be a suitable decoration.

You decide that you want behemothic replica Easter Island heads by the eighteenth pigsty instead. You call your landscaper from before, only he tells you he doesn't do Easter Island heads—you lot'll accept to talk to someone with a bigger performance.

Y'all make it touch with Global Stonework Megacorp Inc., and they're but likewise happy to install the heads. The charge is $half-dozen,000 (a fiddling pricier than palm copse, but this is a long-term investment).

You don't have to worry nigh sending a 1099 to Global Stonework Megacorp Inc., because they're a corporation, non an independent contractor.

How Demote can aid

Whether you receive a 1099-NEC or need to issue one to a contractor, having clear, authentic, and up-to-date books are essential when it's time to file your taxes. Your Bench bookkeeper tin provide detailed yr-end financial statements, including a 1099-specific study, that make tax filing a cakewalk.

In January, your Bench-provided 1099 report tells you:

- Who y'all demand to file 1099 NECs for

- How much you paid each person and what they were paid for, including the transactions associated with those payments

Nosotros'll even let you know whether you need to file an NEC or MISC form for that 1099. Learn more than.

How to file a 1099 form

There are two copies of Form 1099: Copy A and Copy B.

If yous hire an independent contractor, you must report what you lot pay them on Re-create A, and submit information technology to the IRS. You must report the same information on Copy B, and transport information technology to the contractor.

If you're an independent contractor and you receive a Form 1099, Copy B from a client, you do not need to send it to the IRS. You written report the income listed on Re-create B on your personal income tax return.

Course 1099-NEC, Copy B (This is the 1 yous ship to your contractors.)

Course 1099-NEC, Copy B (This is the 1 yous ship to your contractors.)

1. Get together the required information

Before yous tin can complete and submit a 1099, you'll need to have the post-obit information on hand for each independent contractor:

- The total amount you paid them during the revenue enhancement year

- Their legal name

- Their address

- Their taxpayer identification number (likely their Social Security Number, unless they're a Non-Resident or Resident Alien)

The standard method for acquiring this data is to take each contractor make full out a Course W-9. As a best exercise, you should have a Due west-9 on file for each of your independent contractors. Having contractors fill up out a W-9 should be one of the first administrative tasks you lot complete afterward engaging their services.

Cheque your bookkeeping records to confirm the full amounts y'all paid to each contractor during the tax year.

In one case you have all of the required information, use information technology to fill out Class 1099-NEC.

two. Submit Re-create A to the IRS

Copy A of Form 1099-NEC must be submitted to the IRS by January 31, regardless of whether yous file electronically or by mail.

When you file a concrete Course 1099-NEC, you cannot download and submit a printed version of Copy A from the IRS website. Instead, yous must obtain a physical Form 1099-NEC, fill up out Copy A, and mail it to the IRS.

Larn how to get physical copies of Form 1099-MISC and other IRS publications for free.

3. Submit copy B to the independent contractor

Once your Form 1099-NEC is complete, ship Re-create B to all of your independent contractors no later than January 31.

You can download and print a version of Copy B from the IRS website and send it to your independent contractor. This procedure is explained in further detail on the first page of Form 1099-NEC.

4. Submit form 1096

If you file a concrete copy of Course 1099-NEC, Copy A to the IRS, you lot also demand to complete and file Class 1096.

The IRS uses Form 1096 to track every physical 1099 y'all are filing for the year.

The deadline for Class 1096 is Jan 31.

v. Check if yous need to submit 1099 forms with your land

Depending on where your business organisation is based, you may besides accept to file 1099 forms with the land. Cheque in with your CPA and ensure yous're compliant with your state'due south 1099 filing requirements.

How to file 1099s online

Copy A

You can e-file Copy A of Form 1099-NEC through the IRS Filing a Return Electronically (Fire) system. This course must be produced with the assistance of uniform accounting software.

Before using FIRE, you need a Transmitter Command Lawmaking (TCC). You can request a TCC by filling out Grade 4419 and then mailing or faxing information technology to the IRS. This class must exist submitted at to the lowest degree 30 days before the taxation deadline for your Class 1099-NEC.

One time the IRS contacts you with your TCC, you may use it to create an account with FIRE.

Copy B

You tin can electronic mail Copy B to your contractor, only first you need their consent to exercise so.

Consent should be obtained in a mode that proves the contractor can receive the form electronically. If you're planning to e-mail them a re-create, you lot should contact them via email to obtain consent.

To comply with IRS rules, your request for consent must include the following:

- Affirmation of the fact that, if the recipient does non consent to receiving an electronic re-create, they will receive a newspaper i.

- The telescopic and duration of their consent. For example, are they agreeing to receive an electronic copy this year, or every calendar twelvemonth they work for you?

- How to request a newspaper copy from you, even if they have given consent to receive an electronic 1.

- Instructions on how to withdraw consent. They may withdraw consent at any time in writing, electronically or on newspaper. Y'all must likewise confirm their withdrawal in writing.

- Nether what conditions the statement may no longer be provided—for instance, if the contractor'due south contract is cancelled, or if you terminate upward paying them less than $600 for their services.

- The procedure they need to follow to update their information with you.

- A description of the hardware and software they need to view and impress the class.

- A date at which the form volition not be bachelor. For case, if you lot are making it available to download via your visitor's website, you must tell them at what point in time the form will be removed from your servers.

Once you lot've received consent from the contractor, you lot are gratuitous to send them their Re-create B electronically.

Some services tin can brand this procedure less labor intensive. (Gusto, for example, automatically requests electronic filing consent from all of your contractors.)

When are 1099s due? (2022 deadlines)

Copy A

The deadline to file Copy A with the IRS is January 31, 2022, if y'all're reporting payments in box 7.

Copy B

The deadline for sending Re-create B of Form 1099 to your contractors is January 31, 2022.

What if you don't receive a 1099 from a business?

If you're a contractor, information technology'southward your client's responsibility to send you lot a completed re-create of the Grade 1099-NEC by January 31.

If you haven't received Copy B of a 1099 from your client by the borderline, and y'all believe yous should have, make sure you request it. You will need it to file your income taxes in April.

Regardless of whether you receive a Form 1099-NEC, you must written report all income earned on your tax render.

What happens if yous miss the 1099 filing deadline?

Missing the deadline is non the end of the world, but you will have to pay the post-obit IRS penalties for each late 1099 course:

- $50 if you file within xxx days

- $100 if you file more than 30 days tardily, merely before August ane

- $260 if you file on or after Baronial 1

If you intentionally neglect to file, y'all may be subject to a minimum penalty of $530 per statement, with no maximum.

The amount of the penalisation is based on when you file the correct information return. If y'all aren't able to file on time, you tin can request an extension using IRS Form 8809. But this does non extend the Jan 31 borderline for submitting a copy of the 1099 to independent contractors.

Do I Need To Register As A Business If I Get A 1099 Form,

Source: https://bench.co/blog/tax-tips/1099-form/

Posted by: blackbuseareped.blogspot.com

0 Response to "Do I Need To Register As A Business If I Get A 1099 Form"

Post a Comment